Banking Complaints

A bank refers to a financial institution that accepts deposits and creates credit. Banks are of utmost importance to the economy and are a safe place to deposit excess cash.

The Indian Banking sector is ranked 6th across the globe. With many private sector and public sector banks thriving in India, the banking industry is congruously capitalised and well-regulated by the Reserve Bank of India. The stats on market, credit and liquidity bespeak the handy preparedness to sustain any global crisis.

India is presently home to 34 banks out of which 22 are private sector banks, and 12 are public-owned banks. Multiple other Foreign Private Sector Banks are operating as part of the Indian banking sector as well. Let us take a look at the Top 5 Famous Banks in India.

Famous Banks in India

1. State Bank of India: SBI is the oldest and also the largest bank functioning in India and has been a Fortune 500 company for 14 long years. Post-Independence, the State Bank of India got enacted on 1st July 1955. It has its headquarters located in Mumbai, the financial capital of the country.

The bank has 57 Zonal centres and 14 Local centres with 85,356 branches and 59,291 ATMs pan India. SBI has a market cap of INR 2,93,218.11 crores with a market share of 23% with its presence in 36+ countries. It has been recognised as the Best Transaction Bank & Best Payment Bank in India.

Total Assets – INR 30 lakh crores

Revenue – INR 3.68 lakh crores

Number of employees – 2,64,041

2. HDFC Bank: The bank is well known for receiving first 'in principle' consent from the Reserve Bank of India (RBI) which authorised it to set up a bank in the private sector. It was founded in August 1994 given the liberalisation that took place in the Indian Banking Industry.

The bank started its operations as a Commercial Bank from January 1995. With its headquarters in Mumbai, The Housing Development Finance Corporation Limited (HDFC) functions across 2,768 towns and cities with 5,314 branches and 13,610 ATMs in India. It has a market cap of Rs.6,25,666 crores as of 2019.

Total Assets – INR 11.89 lakh crores

Revenue – INR 1.17 lakh crores

Number of employees – 98,061

3. ICICI (Industrial Credit and Investment Corporation of India) Bank Private Limited: It occupies the second place when it comes to volume of assets operated by the bank. The bank is the second largest in terms of market cap and total assets, making it the leading private sector bank in India.

ICICI was formed in 1994 with the principal aim to offer medium-term and long-term project funding to Indian businesses. The bank has its headquarters in Mumbai with its registered office in Vadodara, Gujarat. It currently has its footprint across India with 5,275 branches and 15,589 ATMs along with its presence in 16 countries outside India.

Total Assets – Rs. 13.77 trillion

Revenue – INR 1.49 lakh crores

Total employees – 82,724

4. Punjab National Bank: The Punjab National Bank, PNB is the third-largest bank functioning in India. The bank serves more than 80 million customers with 7000 branches and 10,681 ATMs, expanding its footprint to 764 cities. It currently operates from its head office located in New Delhi.

Founded in 1894 from Lahore, the bank has served eminent freedom fighters of India. It later got nationalised in July 1969. As one of the oldest banks in the country, it has a market cap of Rs. 37,411 crores as in 2019. PNB recently bagged the prestigious IBA Banking Technology Awards.

Total Assets – INR 6 lakh crores

Revenue – INR 80,512 crores

Total employees – 70,801

5. Bank of Baroda: Bank of Baroda has now become the third-largest lender of the country after it merged with Vijaya Bank and Dena Bank into a single entity. It carries a pride of 127 million customers across 21 countries and growing bigger and better day by day.

The bank operates from its main office in Vadodara and has 9,500 branches and 13,400 ATMs across India. Founded in July 1908, it has a market cap of more than 35,000 crores currently.

Total Assets – INR 11.5 trillion

Revenue – INR 91,000 crores

Total employees – 48,807

Top Banking Complaints in India

According to a recent survey by Times of India, every hour 11 people complain against their bank. The most commonly reported banking complaints in India by consumers include bad customer service, checks/funds bouncing, extra charges levied, debit/credit card blocked etc.

Almost 30% to 37% of bank complaints occur due to the bank's failure to fulfill commitments and lack of fair practices. Banks reporting fraud or complaints have been on the rise more than ever before. What's more disturbing is the account holders face never-ending issues even after being connected with the banks for a long time.

Around half a million people have reported filing complaints in the last five years. From high interests to willful delay in processing payments (leading to penalties), and lack of fair practices to denial of closing accounts, banking customers are having a tough time continuing with the financial hassle.

The numbers of banking complaints see a double-digit rise in the past few years. The financial period of 2018-19 witnessed a surge of 20% in the complaints against banks. Non-adherence to fair practices saw the most number of complaints followed by issues related to pension, levy of charges, and debit and credit card issues.

1. Hidden fees

Customers feel cheated about the excessive fees and hidden charges by the banks. Most often, customers are not aware how they can choose to stay out of overdraft protection. Unexpected charges by bank remains a major issues for consumers from Bangalore, Pune, Mumbai to Patna. Reaching out to their bank is always a good idea to have a clear picture of fees and extra charges.

2. Bad customer support

This is something which every customer is concerned about. Even if the customers manage to reach out to the customer service, they don't see any credible solution. It gets quite worse when the bank employees are unable to resolve your issue. Being heckled from person to person, and being asked to wait at every desk test the best of temper.

The only solution you have is to stay calm and wait for the response from the bank to get the issue resolved.

3.Beneficiary does not get the money

This is one of the most common issues faced by banking customers in all the major cities in India like Mumbai, Bangalore, Pune, New Delhi and Kolkata. The amount gets deducted from their account, and it is shown that the transaction is successful, but it doesn’t get credited into the beneficiary’s account. EMI payers mainly lodged such complaints that the EMI would get deducted from their account but would not be credited to the beneficiary.

4. Fraudulent transaction

According to the Economic Times, there is a rise of 74% in banking frauds. Digital transactions via net banking and UPI are preferred over cash for a contactless mode of payment. But with an increase in online payments, there has been a rise in fraud cases.

Many customers complain that the money from their account has been deducted for things they have not purchased. Banks take a lot of time in addressing such complaints, and usually, customers get frustrated with the process.

5. Transaction failure

Transaction failures are very frustrating and embarrassing. When consumers are out, and they haven’t carried the cash, they will pay via net banking or UPI or ATM, but sometimes bank servers would go down suddenly, and the transaction would fail, or in some cases, the amount would get deducted, and the transaction would fail which can be misleading for both payer and recipient.

How to resolve Banking complaints?

1. First and foremost step should be contacting the bank’s customer care itself as they genuinely care about the customer satisfaction and would be willing to resolve the consumer complaints. Here are customer care number of some of top banks in India :

State bank of India (SBI) Customer Care - 1800 425 3800

Union Bank of India (UBI) Customer Care - 1800 22 2244

Allahabad Bank Customer Care - 1800 57 22 000

Bank of Baroda Customer Care - 1800 102 4455

UCO Bank Customer Care - 1800 274 0123

Bank of Maharashtra Customer Care - 18002334526

Bank of India (BOI) Customer Care - 1800 22 0229

Central Bank of India (CBI) Customer Care - 1800 22 1911

HDFC Bank Card Customer Care - 1800 266 4332

ICICI Bank Customer Care - 1800 200 3344

Punjab National Bank (PNB) Customer Care - 1800 180 2222

Axis Bank Customer Care - 1860 419 5555

2. Apart from calling customer care numbers, a customer can visit the bank and meet the officials or complain at the grievance cell to sort out the issue. However, you should try submitting your complaint to the bank in writing, to keep a record of your complaint. Also, some banks have an option of filing a complaint at their website also.

3. However if the bank is unwilling to address the issue then you can approach the Banking Ombudsman. A banking ombudsman is a senior official appointed by the Reserve Bank of India (RBI) to resolve consumer complaints against deficiency in the banking services. So far there are a total number of 15 Bank Ombudsman whose number can be found on the official RBI website.

The consumer has to file a complaint at the ombudsman under whose jurisdiction the bank branch is located. All the consumer has to do is write it down on paper, or send a complaint via email. There are no charges for filing a complaint. However if you are not satisfied with the settlement offered by the ombudsman, you can file an appeal before the appellate authority within 30 days.

4. Send Legal Notice:

A Consumer can send legal notices to the Bank in case it is unable to resolve his complaint. It is one of the efficient ways to handle consumer complaints legally. Check below to know how to send a legal notice to a Bank?

Step 1: Firstly, get a legal notice drafted by a lawyer.

Step 2: Check it properly and make sure it is signed by a lawyer.

Step 3: Keep a copy of it for future purposes.

Step 4: Send the legal notice to the Bank by registered post.

Step 5: Keep the slip or delivery report for evidence.

5. File consumer forum case:

Consumer forum deals with consumer complaints and you should approach the consumer forum if you feel that your rights as a consumer have been violated.

If your Bank is not responding to your complaint even after sending legal notice by a lawyer then you should file a case against it in a consumer court.

Here is how you can file a case against the Bank in the consumer court?

Step 1: Intimate the aggrieved party via legal notice.

Step 2: Draft the consumer complaint

Step 3: Attach all the relevant documents and proofs to support your complaint.

Step 4: Select the appropriate court for filing the complaint.

Step 5: Pay the prescribed court fee that is required to be paid along with the complaint.

Step 6: Submit the case along with the affidavit & fees in the court.

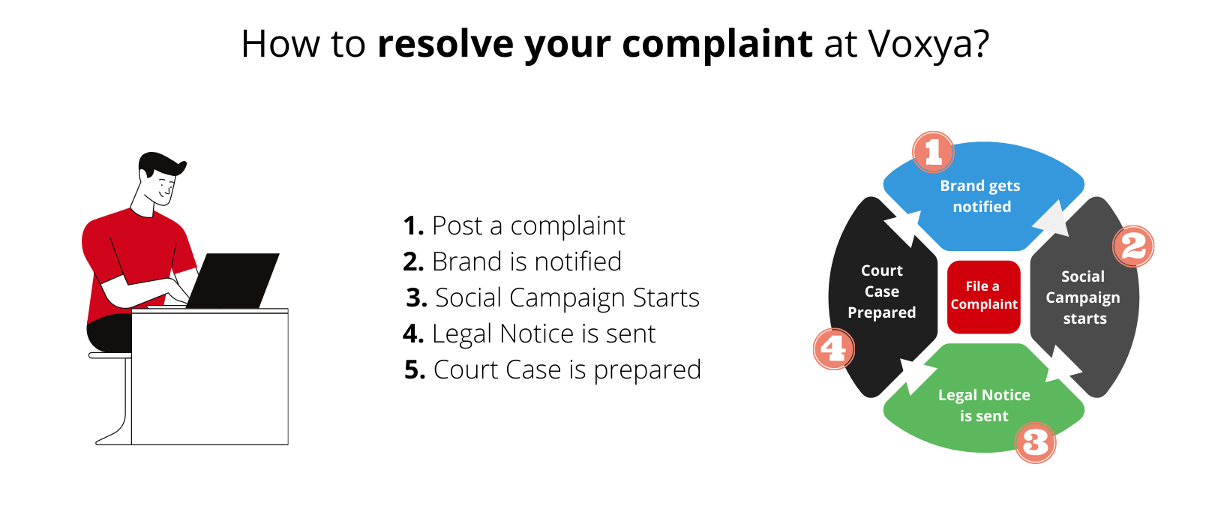

There are strong chances of nothing being done against your complaint if you're not serious about it. So, if you are still left stranded with nowhere else to go then you can always file a consumer complaint at Voxya. We at Voxya, generally receive around thousands of Banking complaints in a month.

So how do we actually resolve these Banking complaints? We start a social media campaign and then send an email to the Banks to resolve the complaint amicably. Moreover if strict actions need to be taken then we draft a legal notice and send it to the concerned Bank.

Most Common Issue Reported for Banking Complaints

Complaints

Amount not credited (Phonepe) Open

Am amount transferred ***** from yes bank to canara bank account through PhonePe app on **/**/****. But amount didn't credited to receiver bank and in debited account amount also deducted. Ofter that I raised complaint like despute form. Ofte...

Apr 15, 2019 by Manjunath A P

ATM failed transaction (State Bank of India ) Open

I have a salary account ( Customer id: ********) in HDFC Bank, Vijaynagar Branch, Mysore. I am working in Raghupati Singhania Cetre of Exellence. I had withdrawn Rs *****/- on **.**.**** ( approx *.** pm), but the transaction was failed due to ...

Apr 15, 2019 by Arnab Dutta

Coupon code provided for deal is invalid (PayTM) Open

I have purchased a deal worth Rs **** on Paytm app and the coupon code which they have provided is invalid. Kindly provide me with a valid coupon code or help me to get the refund my **** Rs....

Apr 14, 2019 by Anisha khatri

Refund not received (Sbi Bank) Open

I have placed * same orders of Rs **** from Flipkart on *th April and paid through my SBI debit card. Then I have cancelled the order so that I should get the * refunds of **** Rs. As the seller has refunded me already on the same date and it s...

Apr 13, 2019 by Sarita pani

Problem while removing my mortgage paper (Hdfc Bank) Open

A/c No: ************** (Jabbar Trading Company) **************(Bharat Oil Mill) I am having the credit facility at Hdfc bank in the name of Jabbar Trading Company and Bharat Oil Mill for Rs ** lac in both firm total *.**Cr. I am getting prob...

Apr 13, 2019 by Aslam Chini

Payment got failed (Airtel Payment Bank) Open

I filled my electric bill through airtel payment but it failed and my payment is not refunded to me. Detail of the message that was received from the bank of debit balance is below. " ALERT: You've spent Rs.****.** on DEBIT/ATM Card xx**** a...

Apr 12, 2019 by Gurtej singh

Failed transaction balance not refunded (Phonepe And Sbi Bank) Open

I would like to inform you that I have sent the money of Rs ***** to Bharat pay but the transaction was not successful. The payment id is P********************** and the UTR no are ************ and Ref No. Transfer to *************. This transa...

Apr 11, 2019 by Ravi kumar

Cash debited but not transferred (Bank of India) Open

This to inform you that I have transferred Rs. **** from my mobile app account to another party account but unfortunately, cash is debited from my account and the second party is unable to receive the amount. So help me to get my money back as ...

Apr 10, 2019 by Jitesh kumar thirani

Unauthorised amount debited (ICICI Bank Limited ) Open

I was holding ICICI credit card no. **************** but cleared by dues in **** and also got a letter as well as mail from ICICI Bank on ** July **** that I have no outstanding, but still, it showing dues in my card and this I got to know fro...

Apr 10, 2019 by Deepak kumar kanodia

Amount not credited in my wallet (Airtel Payment Bank) Open

I have added ₹**** on * April in my airtel wallet using UPI. My money is debited from my account but not credited in the wallet. I already registered a complaint in the bank as well as Airtel. Bank told me transaction is completed successfull...

Apr 09, 2019 by Vasu garg

Redemption of reward points (Punjab National Bank) Open

I had redeemed **** pnb reward points by ordering an item on **.**.**** as pnb was repeatedly sending the messages to redeem the points. It was printed on the generated receipt that 'Your merchandise will reach you in ** business days' (Receipt...

Mar 06, 2019 by Rajendra Prakash Raturi

I got failed transfer request but payment cut from my account (DBS Bank) Open

i got three message according to this thn i paid to him my another bank And now i want my money back but still no answer from bank...

Jun 12, 2018 by kaushik sutariya

Loss of Credibility (Wrongly Dishonoured Cheque) (State Bank Of India ) Open

I have given a cheque to my creditor for payment for goods procured and Creditor deposited cheque in the bank and not received the funds and Clearing Bank returned the cheque stating insufficient funds . But actual funds in bank were ** times...

Jun 08, 2018 by Ravi Theja

No help from bank / Nodal team - request for loan agreement documents (Axis Bank) Open

Loan no:LP************* / Loan no:LP************* while availing a loan from the axis bank, the bank has not provided the loan agreements which were signed by my mother. the bank is now on repeated requests denying the providing the lette...

Jun 07, 2018 by Johnson

ICICI tax saving bond- 032005-TSB-one (year 2005) (ICICI Bank Limited ) Open

We have one icici tax saving bond- ******-tbs-one (year ****) We wanted to ENCASH our above bond whose original copies has already sent by us to Icici bank but even after ** months time it has not been encashed. We are contacting them da...

Jun 06, 2018 by Rajat Agarwal

Non receipt of interest on e flexi rd done through internet banking (State Bank Of India ) Open

my sbi savings account no is ***********. i have opened two e flexi rd through internet banking. one matured on *rd june **** and other maturing on **th june ****. against one which is matured, i have only got principle amount in my savings acc...

Jun 05, 2018 by saurav kumar

Non Adherenace to RBI Guidelines for Levy of Minimum Balance Chargesa (Canara Bank) Open

We Would Like To Update You On Our Below Issue With Canara Bank, Binovanagar Branch Where They Have Failed To Carry Our Due Adherence To Procedural Guidelines And Circulars Of Rbi In Levying Minimum Balance Charges As They Are Not Able To Pr...

May 28, 2018 by Asha Kanta Sharma

Non Adherence to RBI Guidelines for levy of Minimum Balance Charges (Kotak Mahindra Bank) Open

To, Kotak Mahindra Bank Limited Cin: L*****Mh****Plc****** **Bkc, C - **, G-Block, Bandra-Kurla Complex, Bandra East, Mumbai - ******. Tel No.: +** ** ********, Fax No.: +** ** ********. Website: Www.Kotak.Com I Would Like To Upda...

May 28, 2018 by Asha Kanta Sharma

Negligence in Rendering Banking Services (ICICI Bank Limited ) Open

The below are the issues against your bank as per mail dated **th February **** Now let me highlight you about my experience on visiting my home branch of icici bank for updating my Aadhar Details **nd January ****:- *. I reached there w...

May 28, 2018 by Asha Kanta Sharma

"Thank you so much to Voxya.com. Legal Notice really worked and Byjus had to refund my amount and cancel the loan. Thanks once again Voxya. "

Ramachal V

Complaint filed against: Byjus