TL;DR: Voxya is a prominent Indian Online Dispute Resolution (ODR) platform, focusing on consumer complaints by leveraging social media, business networks, and legal frameworks for quick resolutions. Alongside Voxya, top ODR players in India include government platforms like National Consumer Helpline (NCH) and private ones like CADRE, Presolve 360, Jupitice, and SAMA, all driving digital dispute resolution for consumers.

In today’s digital world, disputes between consumers and service providers are becoming more common. However, the traditional route of resolving these issues in court is time-consuming, expensive, and often ineffective. This is where Online Dispute Resolution (ODR) comes in.

ODR provides a faster, cheaper, and more efficient alternative to resolve issues without stepping foot in a courtroom. With the rise of e-commerce, late deliveries, refund issues, and defective products, ODR platforms are becoming increasingly important in India. In this article, we’ll explore the growing role of ODR in India and highlight the top ODR platforms in India.

What is ODR (Online Dispute Resolution)?

ODR uses technology such as emails, online chats, mobile apps, and the internet to resolve disputes between individuals or businesses. Whether it’s a complaint about a faulty product, deficient service, or contractual disagreements, ODR allows parties to resolve their issues online without the need for in-person meetings or court appearances.

ODR includes several methods:

- Mediation: A neutral third party helps both sides reach an agreement.

- Arbitration: A neutral third party listens to both sides and makes a binding decision.

- Negotiation: Parties work together, with or without help, to find a solution.

- Hybrid methods: A combination of mediation and negotiation, where mediation is attempted first, and arbitration follows if needed.

Since ODR is completely online, all processes from filing disputes to sharing documents, discussing the case, and receiving the resolution are handled digitally.

Why India Needs ODR

India has a massive backlog of over 45 million pending cases in courts, with many of them unresolved for years. Traditional litigation is costly, requires significant travel, and can take years to resolve. For small businesses, consumers in remote areas, and individuals with limited resources, accessing courts is often impractical.

ODR is the perfect solution to these issues. It provides a simple, accessible, and cost-effective way to resolve disputes from the comfort of one’s home, particularly in cases involving e-commerce, delayed refunds, or consumer complaints.

Top ODR Platforms in India

When it comes to Online Dispute Resolution in India, several platforms are making waves, but Voxya stands out as a leading platform for resolving consumer complaints and disputes in a quick, affordable, and fully online manner.

Voxya: The Leading ODR Platform in India

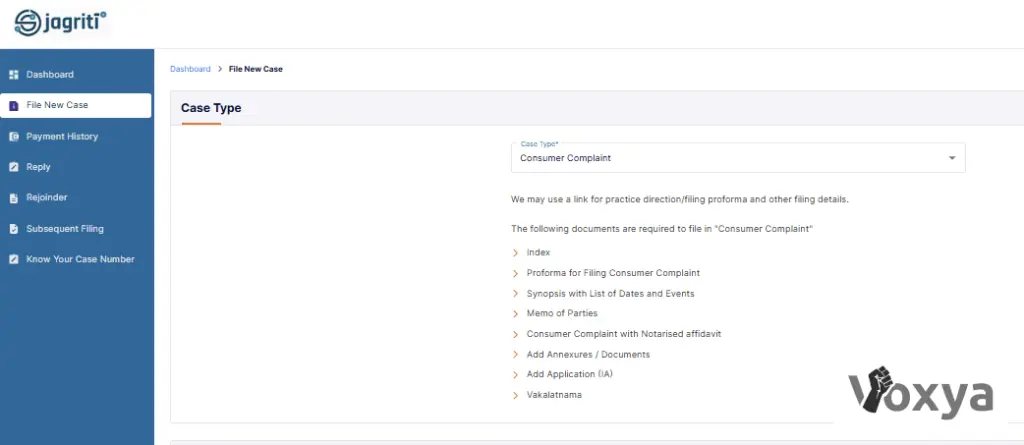

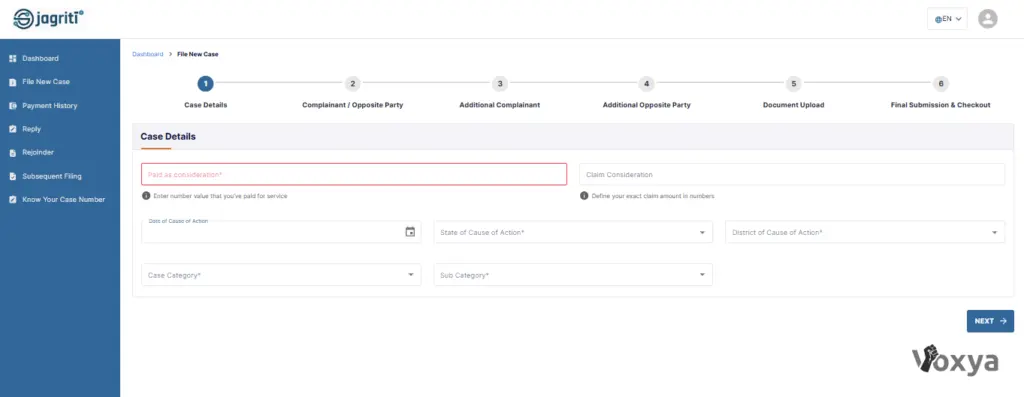

Voxya has emerged as one of the top ODR platforms in India, revolutionizing the way consumers and businesses handle disputes. Whether it’s issues with defective products, delayed refunds, or unsatisfactory services, Voxya provides a comprehensive solution to get resolutions without involving the courts.

What sets Voxya apart is its simple dispute resolution process, which simplifies complaint filing, tracks progress, and speeds up resolution. With a multi-channel approach like incorporating legal experts, verified lawyers, and social media outreach, Voxya ensures that brands are held accountable and responses are faster.

Voxya’s user-friendly interface and commitment to making justice accessible have made it India’s trusted platform for resolving disputes across various sectors like e-commerce, consumer services, and retail.

Other Top ODR Platforms in India

Alongside Voxya, top ODR players in India include government platforms like National Consumer Helpline (NCH) and private ones like CADRE, Presolve 360, and SAMA, all driving digital dispute resolution for consumers.

- Jupitice: A digital ecosystem specializing in ADR (Alternative Dispute Resolution), Jupitice offers a comprehensive range of services including negotiation, mediation, and arbitration. Its use of blockchain technology for document security and AI for case triage makes it a highly secure and advanced platform, best suited for commercial disputes.

- Presolv360: A platform designed for high-value business disputes, Presolv360 connects users with experienced legal professionals. However, it can be more expensive compared to consumer-only platforms, making it better suited for larger disputes.

- Sama: As one of the oldest players in the ODR space, Sama offers reliable dispute resolution services, though it may have slower turnaround times for more complex cases. Still, it’s trusted by many individuals and businesses.

- CADRE: Specializing in real estate, MSMEs, and startups, CADRE provides online mediation and arbitration services. Its smart dashboards for real-time tracking of cases make it an ideal choice for business disputes.

- WeVaad: An efficient platform for resolving consumer complaints, contract issues, and e-commerce disputes, WeVaad handles all stages of the ODR process online—from meetings to document uploads and final resolutions.

The Future of ODR Platforms in India

As more businesses and individuals turn to online platforms for conflict resolution, the future of ODR in India looks promising. We expect to see:

- Increased adoption in sectors like e-commerce, banking, telecom, and property disputes.

- AI-driven solutions that speed up the process of case sorting, document processing, and decision-making.

- Mobile apps and local language options will make ODR accessible even to people in rural areas.

- Virtual Lok Adalats (online courts) may become a mainstream method for handling small cases without the need for physical courts.

After closely analyzing the online complaints received at our Voxya platform, the data reveals a noteworthy trend. Nearly 23% of the total complaints are filed by consumers from remote areas and individuals with limited resources. This highlights the critical role that ODR platforms like Voxya play in providing affordable and accessible solutions for those who may otherwise face significant barriers in accessing traditional legal channels.

Additionally, as India becomes a global hub for online business, Indian ODR platforms may even extend their services internationally, helping resolve cross-border disputes.

How to Choose the Right ODR Platform

Before selecting an ODR platform, here are some tips to ensure you make the right choice:

- Ensure enforceability: Choose a platform that offers legally binding resolutions.

- Read reviews: Look for platforms with positive user feedback and successful case studies.

- Check pricing: Fixed fees tend to be more transparent than percentage-based fees.

- Review time estimates: Consider platforms that provide clear time estimates for dispute resolution.

- Data security: Ensure your documents and personal information are securely handled.

- Language and region support: Make sure the platform supports your language and region.

- Qualified mediators: Verify that the platform has qualified and neutral legal experts, mediators or arbitrators.

Conclusion

As ODR platforms like Voxya continue to lead the way, Online Dispute Resolution is reshaping how India handles disputes. With the ability to resolve conflicts without the lengthy and expensive court process, ODR is making justice more accessible to everyone. Whether you’re a consumer dealing with a refund issue, a small business owner, or an individual facing a dispute, turning to the top ODR platforms in India like Voxya could be the solution to your problem.