In today’s digital era, online banking has become an integral part of our lives. However, there may be times when you encounter issues or disputes with your bank. Whether it’s an unauthorized transaction, a delayed response from the bank, or any other banking-related problem, it’s essential to know how to file a bank complaint effectively. Fortunately, the Reserve Bank of India (RBI) provides a straightforward and convenient process for filing a bank complaint to RBI. This article will guide you through the steps to file a bank complaint to RBI.

Table of Contents

- Introduction to Bank Complaints

- Understanding the Role of RBI

- Gather Relevant Information

- Contact Your Bank

- Filing a Complaint with the RBI

- Provide Detailed Information

- Follow-Up on Your Complaint

- Escalating the Complaint

- Importance of Documentation

- Seeking Legal Assistance

- Conclusion

- FAQs

Introduction to Bank Complaints

If you are facing a problem with the Bank, it is very important to understand how to address a complaint against the bank properly. Bank complaints can vary from unauthorized transactions and account discrepancies to issues with customer service or loan-related disputes. Filing a consumer complaint against a bank ensures your complaint will be heard and resolved fairly.

Understanding the Role of RBI

The Reserve Bank of India (RBI) serves as the country’s central banking institution and regulatory authority for financial matters. One of its responsibilities is to address customer grievances and ensure the smooth functioning of the banking system. The RBI has established the Banking Ombudsman Scheme, which provides a platform for customers to file complaints against banks.

Gather Relevant Information

Before initiating a bank complaint, it’s essential to gather all relevant information related to the issue. This includes bank statements, transaction details, account numbers, correspondence with the bank, and any other supporting documents that can substantiate your complaint. Having these details readily available will help in providing accurate and comprehensive information while filing the complaint.

Contact Your Bank

In most cases, it is important before filing a bank complaint to RBI, it’s advisable to first contact your bank directly to resolve the issue. Banks have designated customer service departments that handle complaints and disputes. You can reach Bank customer care using the customer care number or customer care email id. Keep a record of the communication, including dates and names of the bank representatives you spoke with, as it may be required later during the complaint filing process.

Filing A Bank Complaint to RBI

If your bank fails to address your complaint satisfactorily, you can escalate the matter to the RBI. The RBI has an online portal specifically designed for filing complaints against banks. Visit the RBI’s official website and navigate to the “Complaints” or “Customer Service” section to access the complaint form.

Steps To File A Bank Complaint To RBI Online

Using the following steps you can file a bank complaint to RBI:

Step 1: Go to the following website: https://cms.rbi.org.in/.

Step 2: Click on File A Complaint Page.

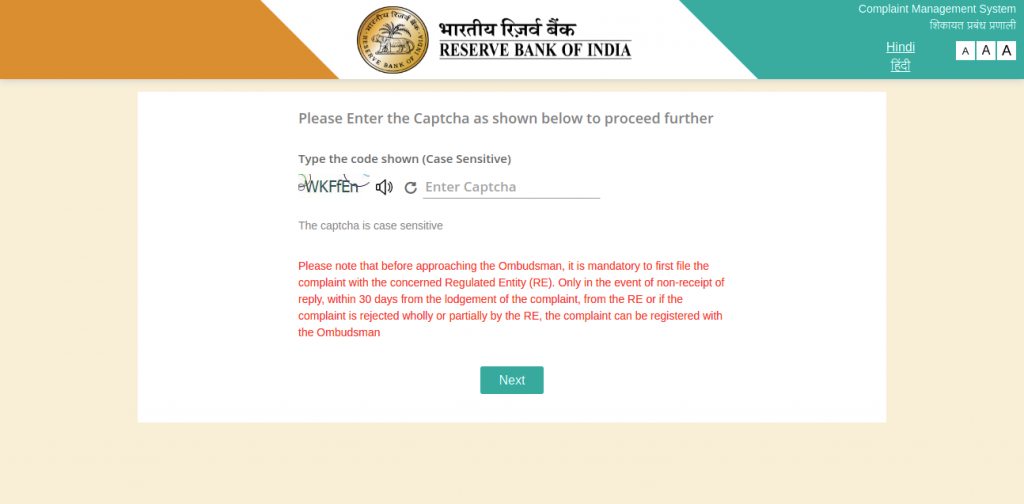

Step 3: You need to fill in a Captcha code and click on the next button.

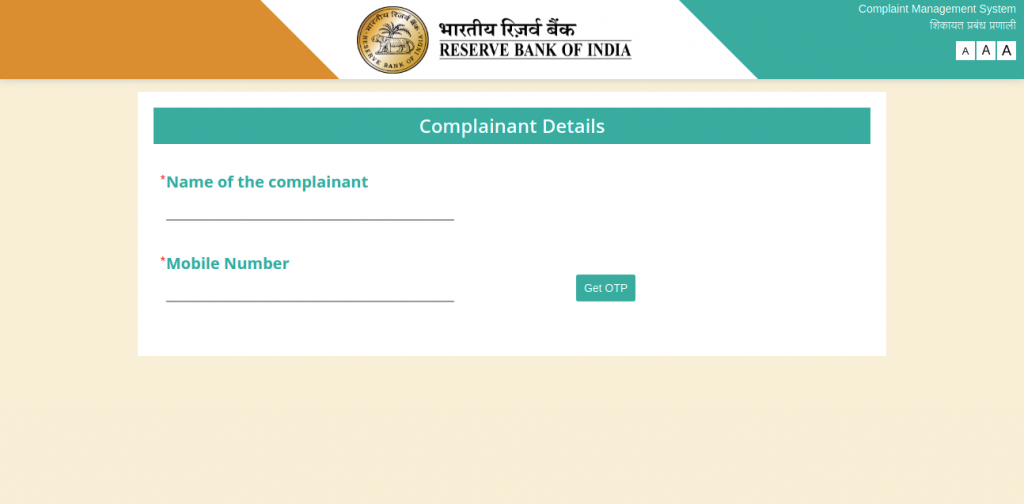

Step 4: Write the Name of the complainant and Mobile Number.

Step 5: You will get OTP, enter OTP, and validate your phone number.

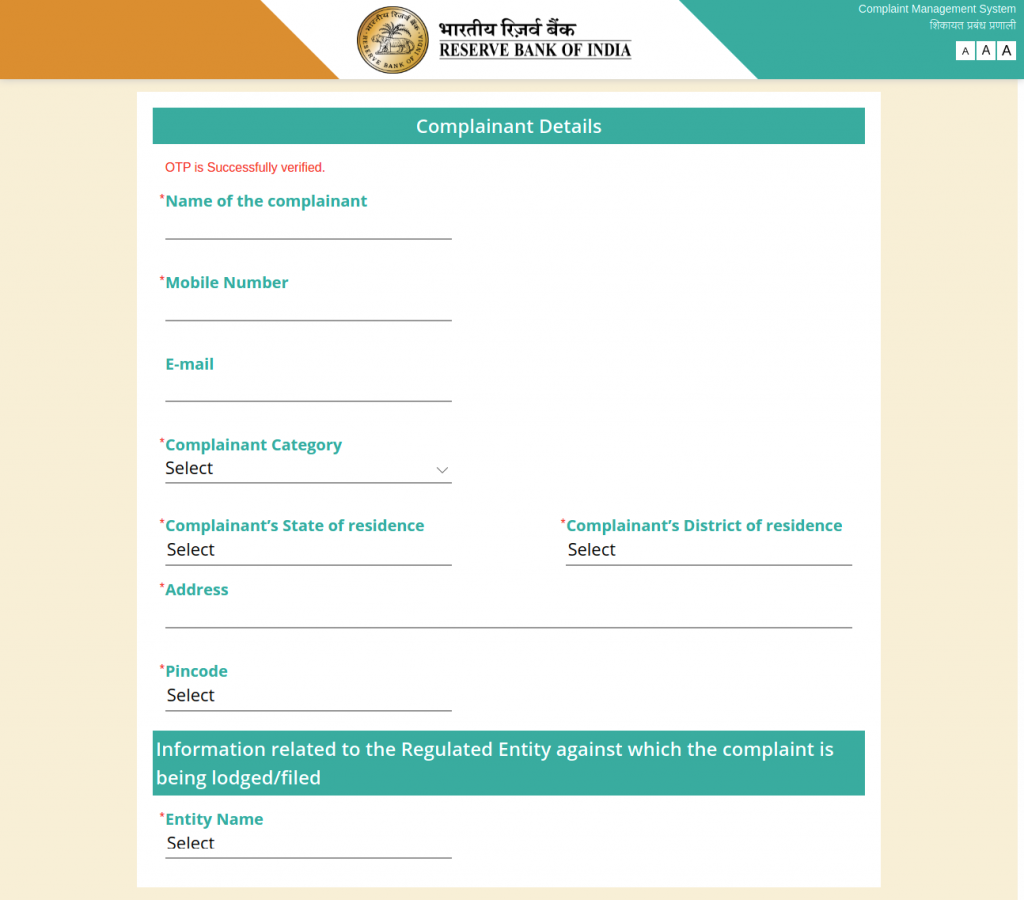

Step 6: Enter complete detail in the form details and choose the entity against which you want to file a complaint.

Step 7: Enter information related to the Regulated Entity against which the complaint is being lodged/ filed.

Step 8: You need to provide information if you already complain to the bank along with evidence.

Step 9: Enter the complaint category and other details

Step 10: Write your complaint in the box and submit your complaint along with supportive documents. You will receive an RBI Complaint ID.

Provide Detailed Information

When filling out the complaint form, provide detailed information about the issue you are facing. Mention the nature of the complaint, relevant account details, transaction dates, and any supporting documents you have. It’s crucial to be specific and concise while explaining the problem to ensure a clear understanding by the authorities handling the complaint.

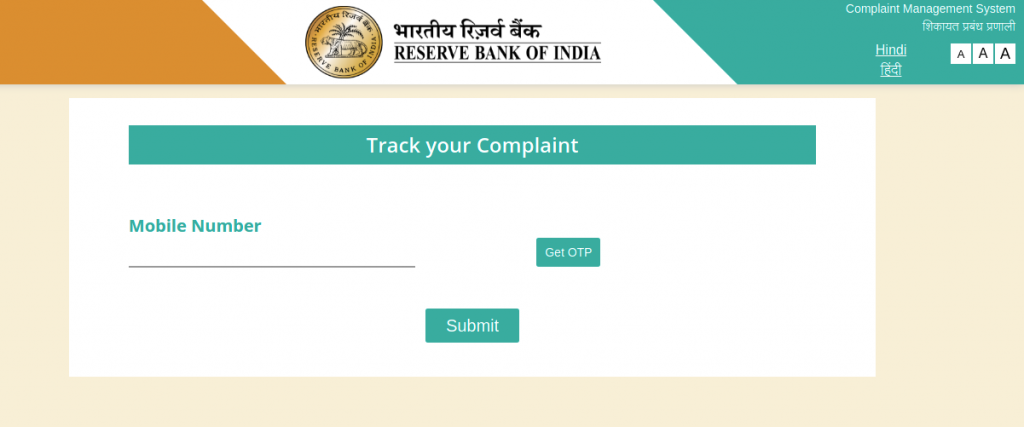

How to Track A RBI Complaint Online?

After submitting the complaint, the RBI will acknowledge the receipt and assign a unique complaint number. Keep this number safe as it will be necessary for future references. The RBI typically resolves complaints within a specified timeframe. However, it’s advisable to periodically follow up on your complaint by contacting the RBI’s helpline or checking the status of your complaint on their website.

If you want to check the status of your complaint then go to the following link: Track SBI Complaint

Enter your mobile number and get OTP to track your RBI complaint.

Escalating the Complaint

If you feel that the resolution provided by the RBI is unsatisfactory, you have the option to escalate the complaint further. The RBI allows customers to approach higher authorities within the organization for a review of their complaints. This escalation process ensures that your concerns receive due attention and are thoroughly examined.

Importance of Documentation

Throughout the complaint filing process, maintaining proper documentation is crucial. Keep copies of all communication, including emails, letters, and complaint forms. These records serve as evidence and provide a comprehensive account of your efforts to resolve the issue. Having well-organized documentation will strengthen your case and help you present your complaint more effectively.

Seeking Legal Assistance

In certain complex cases or situations where your complaint remains unresolved, you may consider seeking legal assistance. Consulting with a lawyer who specializes in banking and financial matters can provide you with guidance on the best course of action. They can help you understand your rights, assess the strength of your case, and represent you if the matter requires legal intervention.

You can talk to a lawyer at Voxya to get legal assistance from a professional and experienced lawyer. They will help you find answers to all your legal queries related to banking complaints.

Conclusion

Filing a bank complaint to RBI ensures that your concerns are heard and addressed appropriately. By following the outlined steps, you can navigate the complaint filing process smoothly and increase the chances of a satisfactory resolution. Remember to provide accurate and detailed information, maintain proper documentation, and be persistent in following up on your complaint.