Table of Contents

- What is a CIBIL score?

- How to check the CIBIL score?

- Key points about CIBIL score

- Range of CIBIL score

- How to improve your score?

- Positively affecting factors

- Negatively affecting factors

- FAQs

The Credit Information Bureau (India) Ltd, most popularly known as CIBIL, is the primary agency that provides credit reports and scores to each user. With the help and information of the financial condition of the users from leading banks and other financial organizations in the country, CIBIL sort outs all the data and provide scores based on the data collected like previous loans history or credit card data. It was founded in 2000 and is expanding to date throughout the country. It has the support of TransUnion International and Dun and Bradstreet, the major global credit bureaus and agencies.

What is a CIBIL score?

A Reserve Bank of India (RBI) authorized credit agency, the Credit Information Bureau (India) Ltd, offers CIBIL scores and CIBIL reports to its users. The score is calculated using the user’s credit details. It also provides credit report services to banks and other non-banking financial companies (NBFC). A CIBIL score consists of three digits, usually ranging between 300 and 900, 300 being the lowest score that can express a person’s creditworthiness. Higher the score, the more benefits one will have. It is calculated based on your financial data from the past six months. The data is fed to an algorithm having 258 different variables, each having its importance.

CIBIL score has its own importance, such as-

- Higher quantum of loan

- Easier loan documentation process

- Flexible and extended repayment tenure

- Lower interest rates on loan

- Quicker loan application process

- If you have a score between 700 and 900, you can expect up to 80% of the total cost of property for a home loan.

And… It has its own benefits, like-

- High credit limit

- More chances of your loans getting approved

- Lower interest rates for your loans

How to check the CIBIL score?

- Visit the official website https://www.CIBIL.com/. Click ‘get your CIBIL score’.

- Select ‘Click here to get your CIBIL score.

- Fill in your name, email ID, password, PIN code, date of birth, and phone number. Attach an ID proof (passport number, PAN card, Aadhaar or Voter ID).

- Press ‘accept and continue’.

- Fill in the OTP you receive.

- Go to the dashboard to view your score.

- You will be redirected to the website, myscore.CIBIL.com.

Key points about CIBIL score

- 750 score is considered an ideal score.

- Credit cards and loan payments have the greatest impact on the scores.

- Try to keep your utilization ratio at 30.

- It is advised to get a credit card with a high upper limit.

- Have a good balance between secured and unsecured debt (A credit card is an unsecured debt while a car loan is a secured debt).

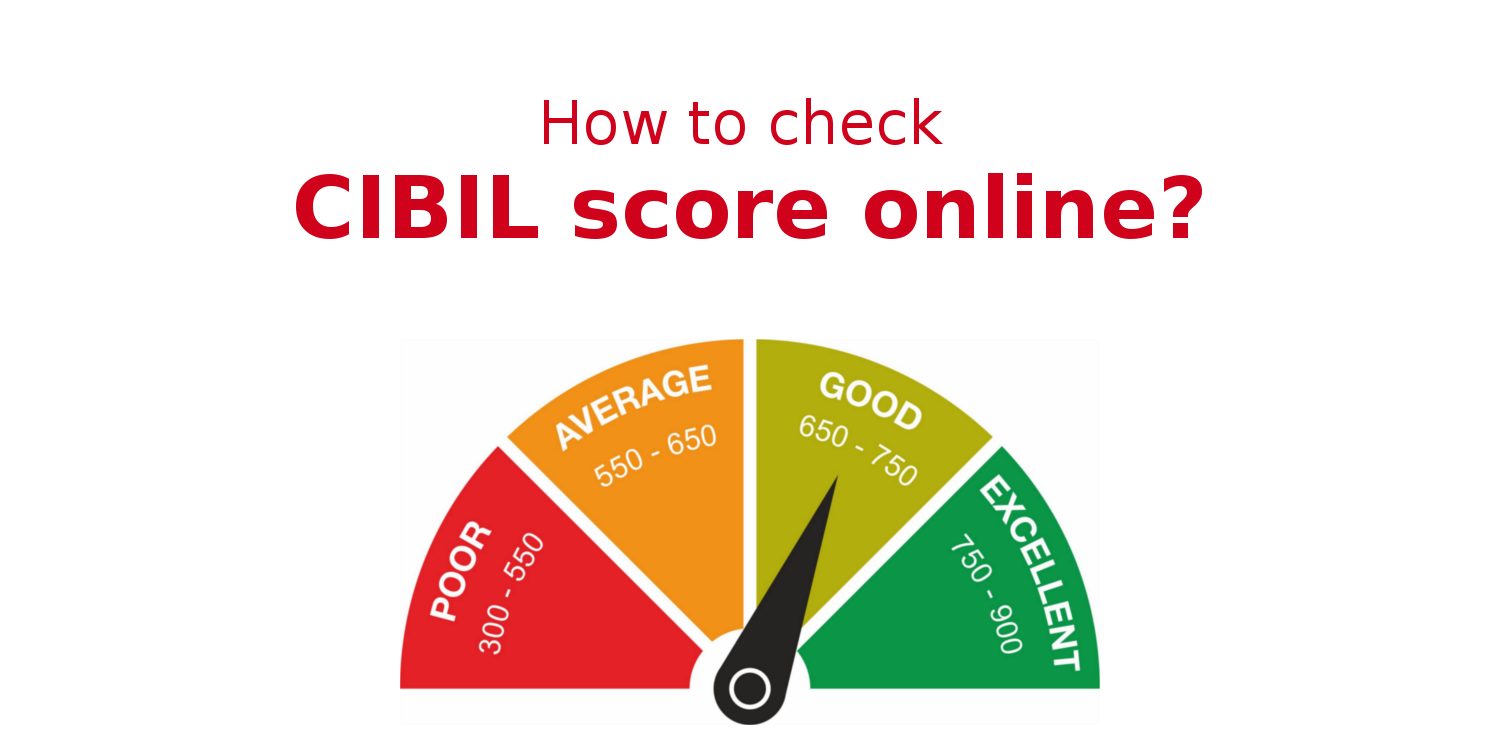

Range of CIBIL score

- NA/NH – Not applicable or no history. You have never used a credit card before until this stage.

- 350-549 – A bad score due to unable to pay the loan EMI or credit card bill on time. Lower chances of getting a loan at this level.

- 550-649 – A fair score. Only a few lenders will grant you a loan at this stage. Interest rates will be very high on your loan.

- 650-749 – A good score. Avoid the delay in paying the bills on time to increase your score to a higher extent. You still may not get the best offer available.

- 750-900 – An excellent score. It indicates you pay your bills on time and brings you the best offer that a bank or credit card company can provide.

How to improve your score?

- Check your CIBIL score regularly

- Monitor your score

- Check if the previous CIBIL report has any errors in it

- If your score isn’t more than 750, you should restrict using your card very often

- Have a higher upper limit of your credit card

- Complete your payments of the bills on time

- Never pay partial amount while paying any bill

Positively affecting factors

- Check your score regularly

- Avoid over-leveraging

- Have a good balance of secured and unsecured debt

- Maintain a low utilization of your credit card

- Pay the credit card bills on time

- Pay the loan EMIs before the due date

- Never do a partial payment while paying your bills

- Maintain a clean financial record

- Have personal copies of the credit report

- Check the report and make sure there are no errors

Negatively affecting factors

- Converting a defaulter as a guarantor

- An irregular pattern of payments

- Not checking your credit score from time to time

- Not examining your report thoroughly

- Maintaining a high credit utilization record

- Having low or no credit record history

- Avoid making several inquiries

- Becoming a defaulter for not paying the bills at a time

- Having a pile of unsecured debts

- Closing old accounts which have a long history

- Getting rejections for your loan multiple times

- Closing credit card with a high upper limit

- Requesting to increase the card limit again and again

- Not solving the error in the reports

FAQs

Will opting for a credit card decrease my CIBIL score?

If you have a zero-balance history on your previous credit card, then no need to worry, and you can close it without any issue. If your credit card with a record, then it will affect your score.

Does zilch credit mean a good score?

If you think ignoring loans will make your score perfect, you are very far from the truth. No loan record directly indicates no transaction records and no points awarded.

Is it possible to check the CIBIL score without paying any fee?

No, CIBIL requires you to pay the fees for viewing the CIBIL report. The CIBIL score can only be obtained after the payment of the fee.

Can CIBIL score change?

If your financial information changes, the score will also change.

Who can access my CIBIL score?

It can only be accessed by CIBIL members like banks, lenders, you and some authorized organizations.

Is PAN required for checking the CIBIL score?

PAN is required in every financial task you will do. PAN is used as the most crucial tool in differentiating all individuals.

Can I delete or amend my credit info by myself?

No, you cannot make any alters to the CIBIL score by yourself. If you have any issue with the CIBIL score, inform the authorities immediately after examining the CIBIL report.

What is the minimum score required for the approval of home loans?

The credit score/report is a part of the loan application review. The banks have the liberty to take an independent decision based on their records as well.

For how long CIBIL keeps the record?

Any data older than seven years is not included in the current CIBIL score or CIBIL report.

How often are the CIBIL reports updated?

The reports are processed every 45 days.

If you are a consumer and not satisfied with the services provided by the company or the seller then you can file a complaint at Voxya, India’s trusted consumer complaint platform for resolving consumer complaints easily with an optimal solution.