Have you found yourself in a situation where you’ve been sold an insurance policy that doesn’t meet your needs, or you’re encountering difficulties when it comes to settling your insurance claims?

It’s not uncommon for some insurance agents to lure customers with false promises, only for them to face significant challenges when attempting to make legitimate insurance claims.

We strongly encourage you to take a moment to watch our informative video, which will guide you through the steps to effectively resolve your insurance-related concerns.

One of the most crucial aspects is to carefully review the terms and conditions at the time of purchasing your policy. If you encounter any issues, remember that you can utilize the free lookup period to your advantage.

To address your concerns, initiate the process by filing a complaint with your insurance company.

File A Complaint in IRDA

If you find that your issue remains unresolved through the above avenue, you have the option to escalate your complaint to the Insurance Regulatory and Development Authority of India (IRDA).

You can send the complaint through Email to complaints@irdai.gov.in to address your complaint IRDA.

You can also file a complaint using IRDA Toll-Free Number 155255 or 1800 4254 732.

Upon doing so, you will receive a token reference number from IRDA, which will enable you to monitor the progress of your complaint.

Lodge You Insurance Claim Complaint in Ombudsman

You can file an Insurance claim complaint with the Insurance Ombudsman. You can go through this link: Register Complaint Insurance Ombudsman

How to register a complaint in Insurance Ombudsman?

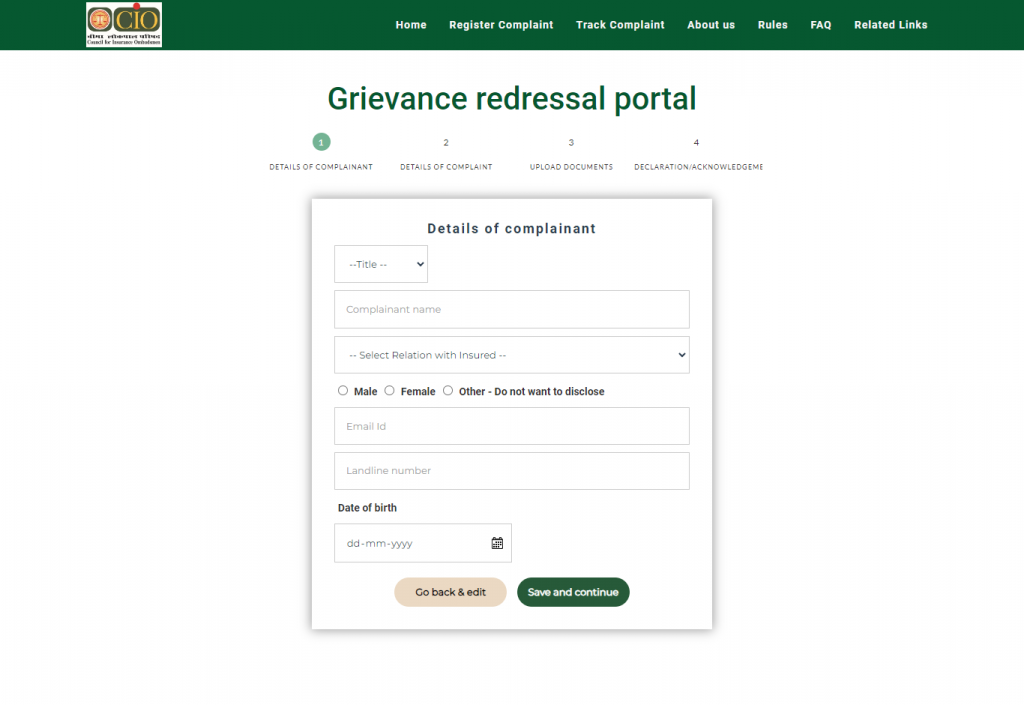

Using the following steps you can register your complaint in Insurance Ombudsman:

- Give the details of the Complainant

- Write detailed information about the complaint

- Upload relevant documents and evidence

- Acknowledge with confirmation about the complaint

- Submit your complaint

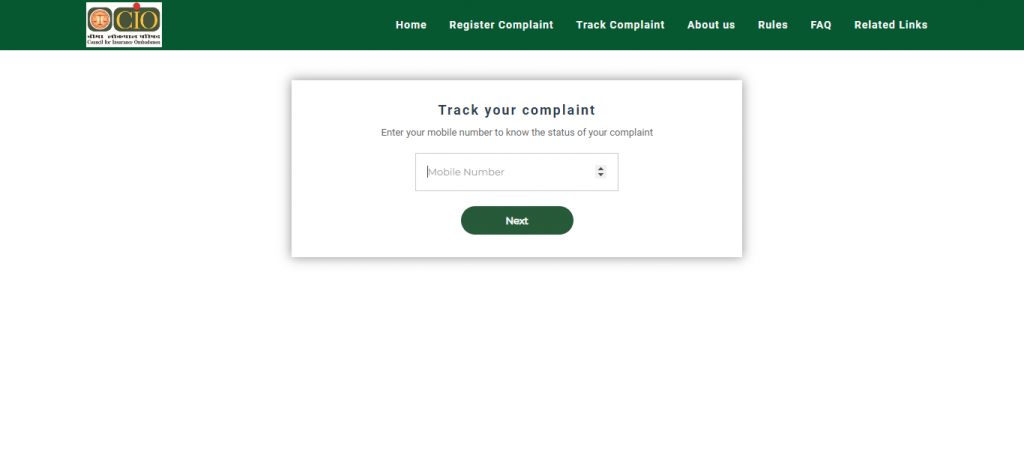

You can also track your complaint using this link: Track Insurance Ombudsman Complaint

You will get attention and It helps to get a resolution from the Insurance service provider.

you can bring your issue in Additionally, you can also bring your complaint to my attention as Ombudsman. Should you still not receive a satisfactory resolution after these efforts, you have the legal recourse of sending a formal notice to the insurance company through a legal representative, demanding a resolution within a reasonable 15-day timeframe.

If, despite all these measures, your concerns continue to be unaddressed, you have the option to file a case against the insurance company in the consumer court.

File Insurance Claim Complaint at Voxya

You can also file a complaint in Voxya, an online consumer forum for policy cancellations, settlement disputes, refund requests, claims for compensation, or reimbursement for legal expenses.

How Voxya resolves Insurance Claim Complaints?

Using the following easy steps Voxya resolves Insurance claim complaints:

Using the following easy steps Voxya resolves consumer complaints:

- Social Media Campaign: It starts a social media campaign for the maximum impact of consumer complaints.

- Send Email: It sends an email to the company and tries to resolve consumer complaints amicably.

- Send legal notice: It will draft and send legal notice to the company via registered post and also send a copy to the consumer’s address.

- Consumer Court: It also prepares consumer case documents, a consumer can submit these documents to file a case in consumer court.

If you are looking for a solution to the complaint, File A Complaint Now!

Your rights as a policyholder are important, and there are established processes in place to ensure you receive fair treatment and resolution for any insurance-related grievances you may encounter.

Voxya is an online consumer complaint forum trusted by more than 2 Lac consumers across India.