Computers, mobile phones, and digital devices along with an Internet connection have changed the way people live, providing them with many benefits. Like everything, these too have a drawback. When the same information technology that is useful to us makes us vulnerable to the threats online it results in financial or emotional damage. This could be because of a cyber crime.

Meaning of Cyber Crime

Any activity which is unlawful in nature, by the means of a computer, or any digital communication device which is being used to commit a crime is known as a cyber crime. Committing a cyber crime is not possible without the help of a proper Internet connection.

Cybercrimes have two main categories:

- Criminal activities that involve computers

- Criminal activities that use computers

The activities which target computers involve the use of malware, for example, a virus.

Criminal activities that use computers for a cybercrime mean the spreading of malware, inappropriate or illegal images, and information.

How to report a Cyber Crime Complaint?

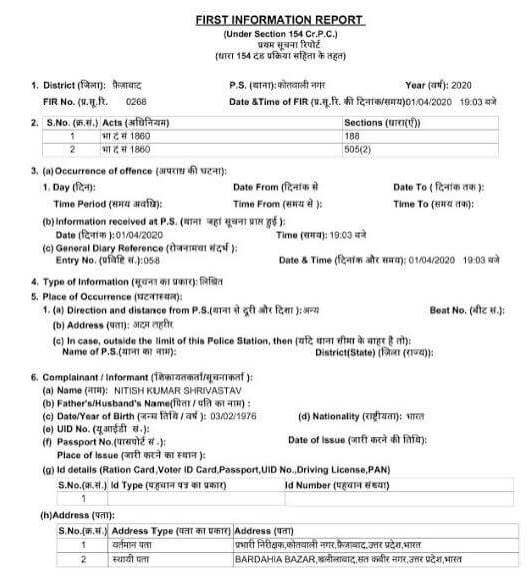

Users who have been subjected to illegal activities through a computer or device can lodge a complaint with the cyber cell of the Police Department. Here are a few examples of the types of cyber crimes committed in the country which are often reported;

Lottery scam, cheating scam, online transaction fraud, fake call fraud, insurance frauds, business email compromises, information or data theft, banking fraud, mobile application or website-related crimes, email fraud, social media crimes, and ransomware.

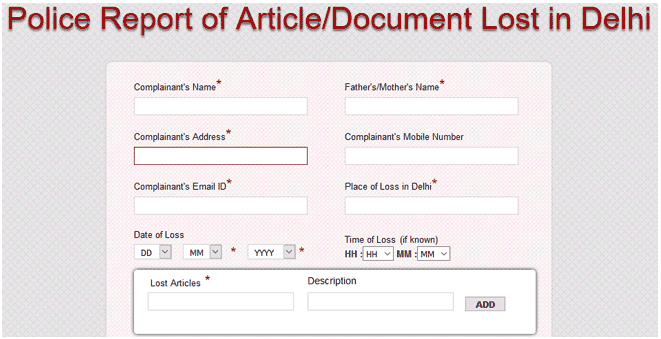

Steps to report Cyber Crime Online

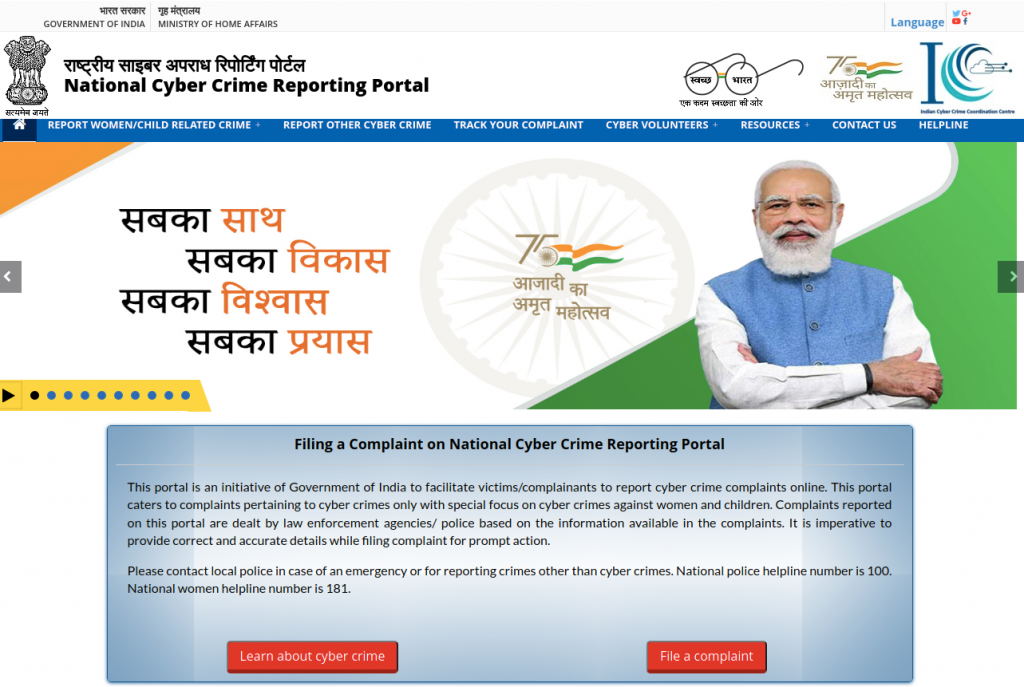

Step 1: Visit the official website registered with the cyber crime department. Type in cyber crime complaint registration in Google or any other search engine. Users can directly access the page through the link cybercrime.gov.in

This link redirects users to the menu page of Ministry of Home Affairs, the national cyber crime reporting portal.

Step 2: In the home page, the first row has seven options, namely;

- Report women and child related crime

- Report other cyber crime

- Track your complaint

- Cyber volunteers

- Resources

- Contact us

- Helpline

Crimes related to women and children can be reported anonymously for precautionary measures. To know more about cyber crime, the page provides a list on which complaints can be filed. This list includes child pornography and child sexually abusive material, cyber bullying, cyberstalking, cyber grooming, online job fraud, online sextortion, SIM swap scam, debit, and credit card fraud, phishing, spamming, impersonating and identity theft, data breach, ransomware, virus worms and Trojans, website defacement, cryptojacking, denial of services and distributed DoS, espionage, online drug trafficking, pharming, and smashing.

Step 3: To report a crime anonymously, in the first option, and click on the file complaint option.

This opens a menu tab where users are directed to read a list of FAQs and terms and conditions before filing the complaint. After going carefully through the details, click on I accept.

Step 4: Another menu tab opens with three options on top Complaint and incident details, suspect details, preview, and submit.

Here, from complaint and incident select the category of complaint from the dropdown arrow and selection options provided. Users can also add extra incident details such as;

- The proximate time and date of the incident or occurrence.

- Reasons why users have delayed reporting the crime if it has been delayed.

- The state, union territory, district, and police station of the area where the incident had occurred.

- Additional information about the incident with a limit of 1500 characters.

After filling in all the details, select save and next.

Step 5: In Step 5 the users have already filed the complaint along with incident details. switch on to the next bar concerning suspect details, description of any information that the user or victim has played an important role in tracking the crime.

Step 6: The preview and submit option is given to ensure that all details and inputs are relatable and correct information. Information added to mislead the cyber cell of the Police Department is an illegal act and is punishable.

These six steps can be followed to lodge a complaint with the cyber cell Police Department at a national level.

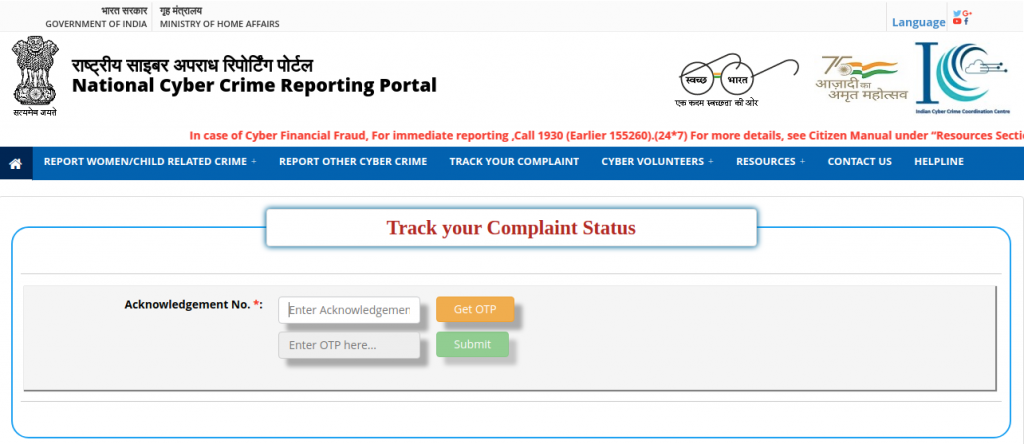

How to Track and report cybercrime complaints

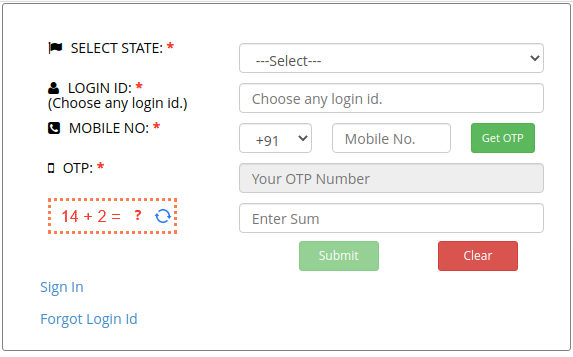

Step 1: Click on the login option, select your state, and give your login ID along with your mobile number. Enter the captcha to submit.

If you are a new user, the link will be provided for you to create an account through complaints registered.

Step 2: Click on the OTP option to get the OTP before logging in or submitting. Never share personal OTP with anyone, and try to delete the OTP message from the device in which it was received for privacy purposes.

Step 3: Once you are logged in, you can follow the similar process of lodging a complaint as shown in the previous steps.

How to Report other crimes online?

Step1: To report other crimes related to cyber cell, visit the same website. Click on the report other crime option, where a similar portal opens and the user reads terms and conditions along with FAQ. Reading the privacy policy is necessary, click on I accept after going through the menu tab details.

Step 2: A menu tab opens with two options- Citizen login and authorized agency login. The details of your state name, username or complainant name, mobile number and OTP.

Step 3: Receive the security code or OTP from the website enter OTP and do not share with anyone else. Users will now be logged in.

Document requirements for lodging cyber security complaints

Users are requested to check the website of their state’s cyber police department. They need different records and documents for different complaints. It will be mentioned in the website itself as complainants proceed with the cyber crime.

For email related complaints

Explain the incident in the explanation box and paste a screenshot of the email, or share a copy of the alleged email. This email should be from the original receiver, avoid forwarding it. It must have a header if any.

Have a hard and soft copy ready, share this soft copy through a CD-R only.

For social media complaints

Take a screenshot of the page, media or profile, URL of the alleged content. maintain hard and soft copies.

For mobile application complaints

Cyber cell crime is very common which is why users are recommended to keep their location switched off as long as possible. Take a screenshot of the application harming the mobile. Include soft copy of the bank statement if any transactions were made from the victim’s account through the mobile application, or for the mobile app. Maintain soft copies of every transaction made.

For business email compromises

Financial information of the following things should be provided in a soft copy- Originating location, name, bank name, and bank account number. Name, bank name, bank account number and bank location of the recipient. Intermediary bank name if available, date, amount of transaction and SWIFT number. Additional information can be included if available, do this by referencing and writing things like FAV (In favour of) and FFC (For further credit).

For data theft

Include a copy of stolen data, copyright certificate of the data which was stolen, and details of suspected individuals who must have stolen the data, if available.

When the company suspects any particular employee, the details required to be provided are- their appointment letter, list of duty assigned, list of clients with whom the individual has been in touch with, used devices of the suspect connected with the company, the proof that they have stolen and sold the data to any other client, gadgets assigned to the individual or employee, and non-disclosure agreement.

For ransomware

The phone number, email ID or any other platform through which the ransom has been demanded. Users are required to take a screenshot of the malware, if attached to the mail or message.

These are the basic types of crimes for which users usually visit the cyber crime portal. For Bitcoin and other related complaints, visit the official portal for the list of information that you need to provide.

As one can see, filing a cyber crime complaint using a government portal can be an extremely time-consuming affair. However, in a situation where you are already feeling harassed, having to slog for hours on end is definitely not a pleasant sight. To that, add the fact that many cases of cyber crime even after being filed, do not result in any long-term consequences for the criminal. Now it becomes quite easy to understand why even in age of rapid digitalisation, the statistics of cyber crimes reported stay more or less constant.

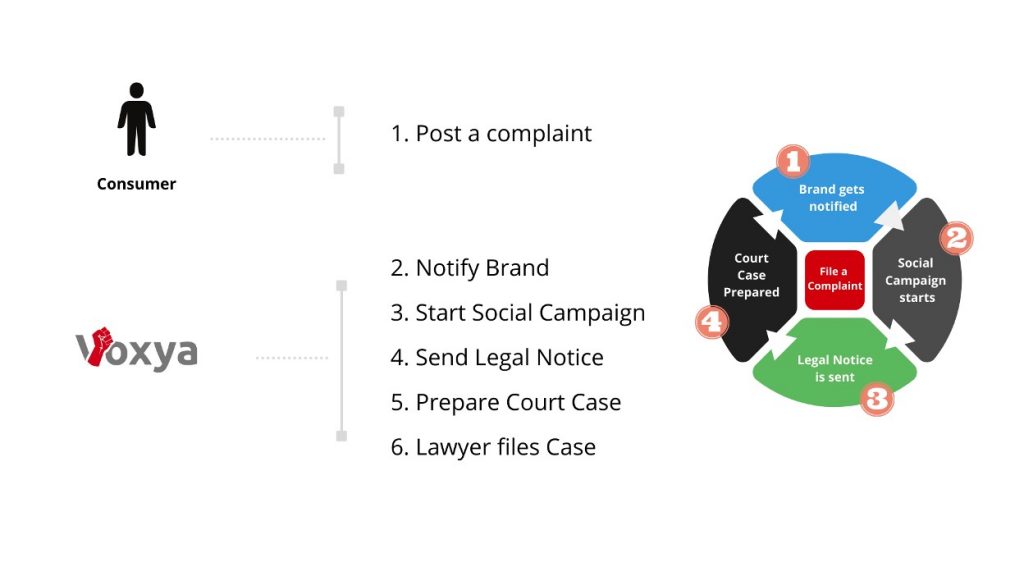

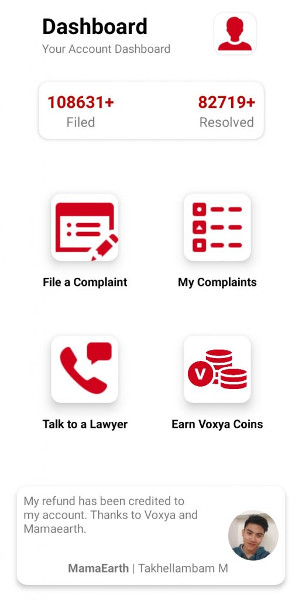

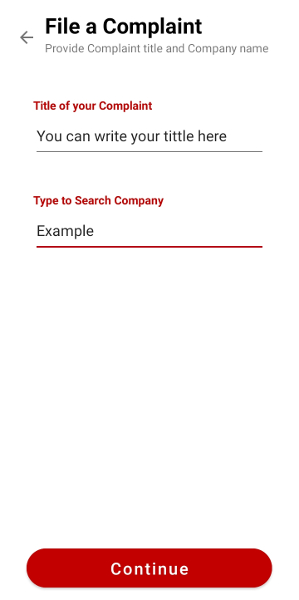

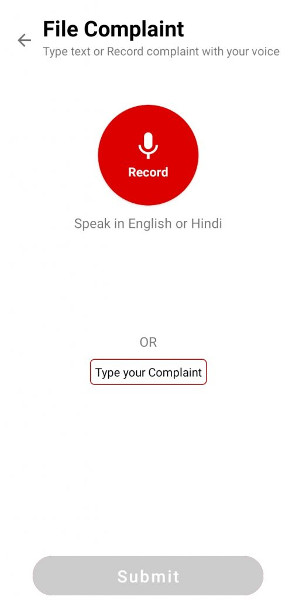

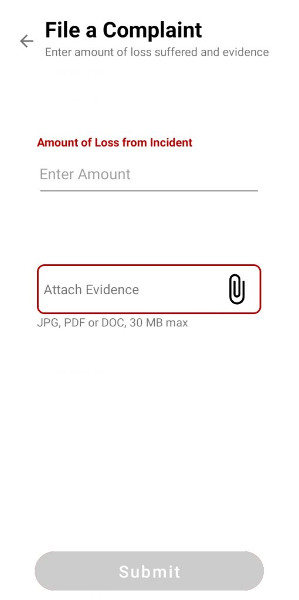

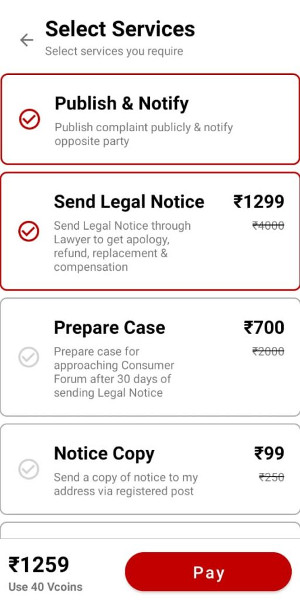

However, if you want your concerns to be heard, and definitive actions to be taken, Voxya may be the right platform for you. Voxya is an initiative to help consumers across the nation take charge of their rights and provides an easily accessible way to regain legal control. The legal team at Voxya collects complaints from disgruntled consumers and sends violators notice through email, post and/or WhatsApp so as to ensure complaints have a higher chance of being acknowledged without the involvement of official forces.

So, if you or a loved one have been a victim of cyber crime, do not hesitate to file a complaint with https://voxya.com/ today.

Cyber Crime Helpline Number

The current cyber crime helpline number is 1930. If you are a victim of Cyber Crime, Dial 1930 to register a cybercrime complaint.

If you become a victim of consumer fraud or online fraud or facing issues related to consumer fraud then you can file a complaint at Voxya.com, India’s trusted online consumer complaint platform to resolve consumer complaints.

Trusted 1 Lac+ consumer.